Former Pennsylvania Governor Opposes Ability Gaming Tax

Former Pennsylvania Gov. Ed Rendell (D) says if lawmakers in Harrisburg need to create a regulatory atmosphere for controversial gray gaming machines, they need to impose a tax charge that mimics what casinos pay on their slots.

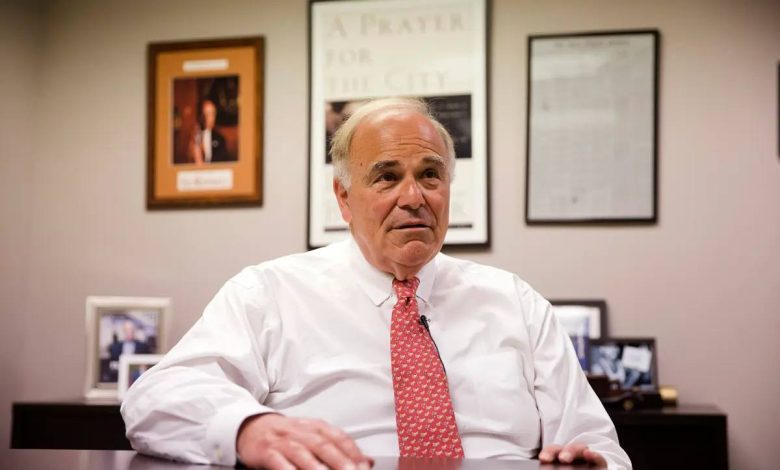

Former Pennsylvania Gov. Ed Rendell sits in his workplace throughout a 2020 interview with the Related Press. Rendell believes if state lawmakers need to tax talent video games, they need to levy a tax that aligns with what casinos pay on their slot machines. (Picture: AP)

Rendell was governor of Pennsylvania from 2003 to 2011. Throughout his time in workplace, Rendell championed the legalization of on line casino playing, particularly slot machines.

Rendell writes that the on line casino trade closely lobbied his administration throughout the state’s improvement of the Gaming Act handed in 2004. Rendell says casinos instructed him the 54% tax on gross income gained by slots was far too excessive and would damper on line casino firms from investing within the state.

20 years later, Pennsylvania is without doubt one of the nation’s richest gaming states with 17 brick-and-mortar casinos and an trade that generated a file $5.7 billion in income final yr.

Ability Tax Ought to Mirror Slot Levy

Ability video games proceed to function throughout the commonwealth in a gray space inside eating places and bars, fuel stations, comfort shops, and different small companies. Enterprise house owners say the machines, which not like a slot require the participant to determine a profitable payline by tapping on the corresponding symbols, have supplied crucial income that has helped offset inflationary pressures. Income from the talent video games is at the moment divvied up between the sport’s software program developer, machine producer and distributor, and the host enterprise.

State courts have dominated that talent video games don’t fall below the scope of the Gaming Act as a result of they aren’t purely video games of likelihood. Pennsylvania Legal professional Normal Michelle Henry (D) is interesting the matter to the state Supreme Courtroom.

Within the interim, state lawmakers who’ve sided with the talent gaming trade have proposed laws to control and tax the gray video games. Home Invoice 2075, a bipartisan statute with 10 Democrats and 10 Republicans lending their assist, would impose a 16% tax on the talent sport win.

Gov. Josh Shapiro (D) has proposed the next tax of round 42%. Rendell says each charges are faulty.

I’m alarmed to listen to that a number of present members of the Normal Meeting are proposing a disastrous tax giveaway that I imagine would profit deep-pocketed, out-of-state gaming pursuits who’ve been flooding Pennsylvania with political marketing campaign contributions. These pursuits function one other sort of slot machine-style system that’s self-serving referred to as a ‘talent sport,’” Rendell wrote.

“Relatively than persist with the time-tested 52% tax charge that has served Pennsylvania nicely for practically twenty years, these legislators need to kill our golden goose and reduce these out-of-state pursuits a sweetheart deal that will tax their machines someplace between a laughable 16% or a clearly non-uniform 42%,” the previous governor continued. “That is the definition of fiscal irresponsibility, in my view. Our authorized gaming trade has already confirmed that every one types of slot machine-style gaming within the commonwealth, together with the sort most much like talent video games — particularly, VGTs — can function efficiently on the 52% charge.”

VGTs, or video gaming terminals, are allowed inside diesel truck stops. VGT income final yr totaled $41.2 million — down barely from the machines’ banner yr of $42 million set in 2022.

Laws Stalls

HB 2075 was launched in February and directed to the Home Gaming Oversight Committee. The talent sport measure has since sat unacted on.

Whereas the 2024 Pennsylvania Normal Meeting’s session runs by Nov. 30, the Home Gaming Oversight Committee doesn’t at the moment have any scheduled conferences.