IRS Warns Sports activities Bettors to Wager Lawfully, Report Winnings

The IRS warned sports activities bettors because the NFL season kicked off on Thursday night time that they need to solely wager with authorized, regulated sportsbooks and that they have to report winnings as taxable revenue.

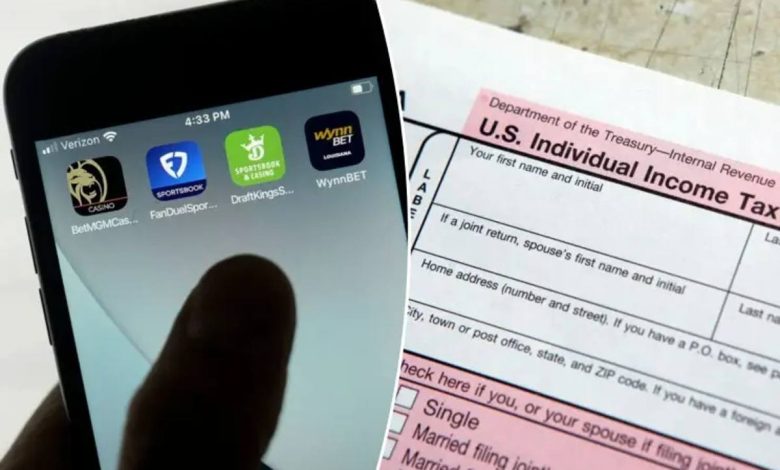

The IRS is reminding sports activities bettors that winnings above $600 are taxable revenue and should be reported on their federal returns. The IRS is concentrating on bettors who fail to conform. (Picture: AP)

Sports activities betting is authorized in 38 states and Washington, DC. The American Gaming Affiliation (AGA) tasks that US bettors will wager a document $35 billion on NFL video games this 12 months with regulated sportsbooks, although much more is prone to be wager by way of underground bookies and unlawful offshore sportsbook web sites.

The IRS encourages bettors to wager solely with regulated operations in authorized sports activities betting states. Those that don’t threat authorized recourse, stated the federal authorities company liable for accumulating taxes.

Sports activities betting has grown exponentially up to now 5 years and is extra frequent than ever. Whereas on-line playing is definitely accessible, it’s not all the time authorized,” stated IRS Felony Investigation Chief Man Ficco.

“As this 12 months’s soccer season kicks off, IRS Felony Investigation particular brokers are persevering with to watch tendencies and utilizing our experience to root out legal exercise associated to unlawful playing like cash laundering and tax evasion,” Ficco added.

IRS Sports activities Betting Crackdown

In its notice urging taxpayers to play by the foundations in the case of sports activities betting, the IRS says it was behind exposing Ippei Mizuhara’s sports activities betting scandal earlier this 12 months.

Mizuhara was the interpreter for Main League Baseball famous person Shohei Ohtani. The tax company stated it labored with Homeland Safety investigators to uncover Mizuhara’s unlawful sports activities betting with an unlawful bookmaking operation that resulted within the interpreter stealing virtually $17 million from Ohtani.

The IRS stated that in June 2023, it additionally uncovered two males in Ohio who have been working a multimillion-dollar underground sports activities betting ring. These people have been efficiently prosecuted and sentenced to 21 and 9 years in jail, respectively.

The IRS isn’t solely specializing in multimillion-dollar infractions. Any taxpayer who violates reporting necessities can face authorized recourse.

Sports activities fanatics who’re not sure about their tax obligations or have questions on reporting playing revenue are inspired to seek the advice of tax professionals or go to the official IRS web site for steering. Ignorance of the tax regulation doesn’t exempt people from their obligations,” the discover learn.

The IRS Felony Investigation Unit has 20 subject workplaces throughout the nation. The company is liable for conducting monetary crime investigations, together with tax fraud. It’s the one federal regulation enforcement company with investigative jurisdiction over violations of the Inner Income Code.

Tax Necessities

The IRS requires that gamblers report their winnings above sure thresholds on type W-2G. Nerdwallet, an internet private finance web site that gives tax ideas, says bettors who win $600 or extra in a tax 12 months should report the cash as taxable revenue on their federal return.

The payout needs to be 300 occasions the quantity risked to mandate reporting. Sports activities betting losses will be deducted in opposition to the $600 profitable threshold ought to the filer itemize their return.

Filers who fail to precisely report their sportsbook winnings threat legal costs starting from cash laundering to tax evasion.