Customary Normal Bally’s Deal Unlikely to Face Antitrust Threats

Customary Normal’s proposed $18.25 per share takeover of Bally’s (NYSE: BALY) seems unlikely to face antitrust scrutiny from federal regulators as a result of the associated ready interval on that matter is about to run out at midnight Monday.

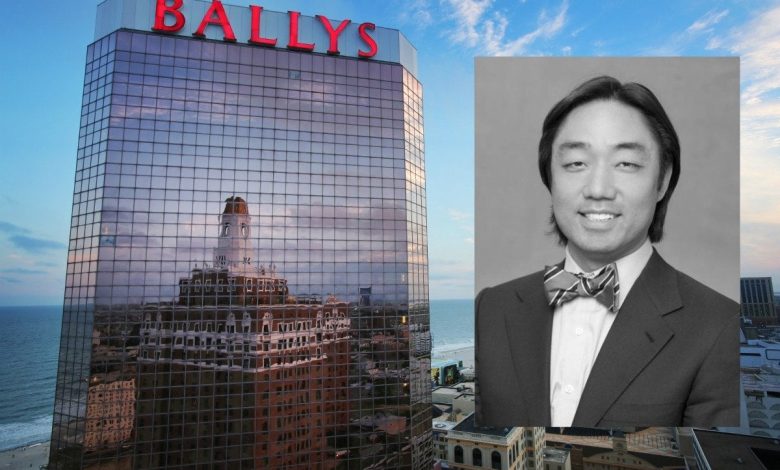

Customary Normal founder Soo Kim. The hedge fund received’t face federal regulatory scrutiny associated to its deliberate acquisition of Bally’s. (Picture: Meet AC/On line casino.org)

Citing two unidentified sources near the matter, CFTN reported Monday that the Hart-Scott-Rodino (HSR) Act pointers pertaining to the deal will expire Monday evening, without having for Customary Normal to file a second request with federal regulators.

Beneath the Hart-Scott-Rodino (HSR) Act, events to sure giant mergers and acquisitions should file premerger notification and wait for presidency overview. The events might not shut their deal till the ready interval outlined within the HSR Act has handed, or the federal government has granted early termination of the ready interval,” in line with the Federal Commerce Fee (FTC).

Customary Normal — the hedge fund that’s the most important investor in Bally’s — floated a $15 per share takeover provide in March. That was upped to $18.25 a share, which the regional on line casino operator accepted in July.

Customary Normal Bally’s Purchase Not Massive Sufficient to Draw FTC Concern

The proposed deal assigns an enterprise worth of $4.6 billion to Bally’s and whereas that isn’t a small amount of cash, it’s not the worth level at which the FTC would contemplate making the customer make changes to the preliminary deal construction.

Rumors that Customary Normal is passing HSR mandates with aplomb arrived as there’s mounting concern within the enterprise group that below Chairwoman Lina Khan, the FTC has taken too laborious a line in opposition to trade, together with strikes to stifle some large-scale mergers and acquisitions.

For instance, the FTC sued to dam the $24.6 billion merger of Albertsons and Kroger — the most important deal on report within the grocery retailer trade — as a result of it’s anticompetitive. Some states have taken up that mantle, too, and have launched their very own antitrust investigations into the merger.

Some Democrat donors have reportedly inspired Vice President Kamala Harris to fireplace Khan ought to the previous win the presidential election in November. The Harris marketing campaign hasn’t publicly mentioned if such a transfer is on the desk.

Subsequent Steps for Customary Normal

With federal antitrust considerations apparently not a problem, the following step for Customary Normal is coping with regulators within the states by which Bally’s operates land-based casinos. These are Colorado, Delaware, Illinois, Indiana, Louisiana, Mississippi, Nevada, New Jersey, and the gaming firm’s house state of Rhode Island.

Attributable to Customary Normal being a hedge fund and never a direct competitor to Bally’s, vital job loss or venue closures seem unlikely to outcome from the acquisition, which may very well be the liking of state gaming regulators. Likewise, it seems unlikely {that a} spate of asset gross sales might be required as has been the case with bigger gaming trade mergers.

Customary Normal is aiming to have the Bally’s acquisition wrapped up within the first half of 2025.