DraftKings Insiders Bought Practically $206M in Inventory This 12 months

Barring any new filings that emerge within the days forward, DraftKings (NASDAQ: DKNG) insiders seem to have bought almost $206 million value of the gaming firm’s shares in 2024 because the inventory notched a market-lagging efficiency.

DraftKings founders (from left) Paul Liberman, Jason Robins and Matthew Kalish seen in Boston in 2015. Insiders on the firm dumped almost $206 million value of inventory this 12 months. (Picture: Boston Globe)

Following December gross sales by Chief Authorized Officer R. Stanton Dodge and co-founder Paul Liberman totaling greater than $30 million, DraftKings insiders dumped $205.54 million of the gaming firm’s fairness in 2024, in response to MarketBeat information, extending a pattern decried by retail buyers.

Including to market individuals disdain for insider promoting at DraftKings is the truth that high-ranking executives on the sportsbook operator aren’t shopping for any inventory. Of the 20 insider transactions this 12 months listed by MarketBeat, together with these by co-founders Liberman and CEO Jason Robins — all are gross sales and none are purchases.

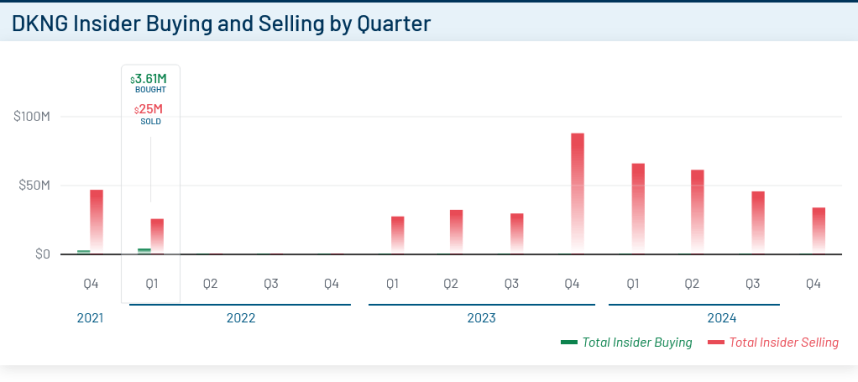

The “constructive” is that insider promoting at DraftKings waned as 2024 moved alongside. After totaling roughly $66 million within the first quarter, that determine declined to $61 million within the April by means of June interval. It fell to $45 million within the third quarter earlier than dropping to $34 million within the ultimate three months of the 12 months.

A chart of insider gross sales at DraftKings. (Picture: MarketBeat)

A chart of insider gross sales at DraftKings. (Picture: MarketBeat)

DraftKings Efficiency Exacerbates Insider Promoting

The constant spate of insider promoting at DraftKings accrued in opposition to the backdrop of tepid returns for buyers. Shares of the gaming firm rose simply 5.53% this 12 months.

Not solely did that efficiency considerably lag the returns of the Nasdaq 100, S&P Choose Sector Client Discretionary, and S&P 500 indexes — every of which gained greater than 25% this 12 months — it additionally badly trailed rival Flutter Leisure (NYSE: FLUT). The mother or father firm of FanDuel — DraftKings’ most direct competitor — surged 44.39% in 2024.

Arguably making issues worse for DraftKings shareholders is the truth that Flutter insiders aren’t frequent sellers of the inventory. Over the previous three months, there have been no insider transactions — buys or gross sales — on the Irish gaming firm.

In September, Flutter introduced a $5 billion share repurchase program, dwarfing the $1 billion buyback plan introduced by DraftKings in August.

Insider Promoting Gentle at Different DraftKings Rivals, Too

The insider promoting at DraftKings stands out as a result of comparable motion at rival iGaming/on-line sports activities betting operators was mild this 12 months and that’s true even when excluding Flutter from the equation.

For instance, insider promoting at Caesars Leisure (NASDAQ: CZR) was lower than $350,000 over the previous 12 months and within the first two quarters of 2024, high-ranking executives on the Caesars Sportsbook proprietor purchased considerably extra inventory than they bought.

At ESPN Guess mother or father Penn Leisure (NASDAQ: PENN), insiders purchased $2.61 million value of shares over the previous 12 months in comparison with gross sales of simply $126,578, in response to MarketBeat information. By way of variety of transactions, buys outnumbered gross sales at Penn by a 4-to-1 margin.