Entain Retains Most of $758K Misplaced by Fraudulent Wealth Supervisor

Entain Australia has been fined AU$78,540 (US$51,800) by regulators within the nation’s Northern Territories. The penalty comes for permitting a rogue wealth supervisor to burn up $758,510 of his shoppers’ cash.

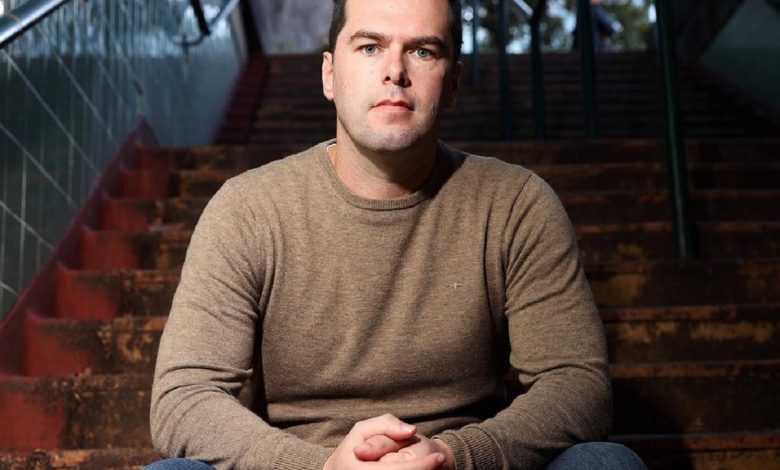

Gavin Fineff has admitted to defrauding hundreds of thousands from a number of shoppers of his wealth administration agency, and might be sentenced subsequent month. (Picture: Each day Telegraph)

However the operator will get to maintain the AU$758,510 (US$500,000) Gavin Fineff, 42, blew by its Ladbrokes sportsbook, regardless of being discovered to have violated Australia’s sports activities betting trade code.

Fineff was charged in Might 2021 with orchestrating an AU$3.3 million (US$2.1 million) fraud to fund a sports activities betting behavior that had spiraled utterly uncontrolled.

Through the 21 months Fineff held a Ladbrokes betting account, he gambled with AU$17.5 million (US$11.5 million), dropping AU$758,510, per courtroom paperwork.

Senior Focused

Police started investigating the high-end monetary advisor after receiving reviews that an 86-year-old lady had been defrauded. They discovered he had stolen funds from a complete of 12 traders, diverting cash meant for shares holdings into his personal checking account, based on prosecutors.

Fineff pleaded responsible in September to a number of fraud-related offenses within the New South Wales District Courtroom, and is predicted to be sentenced subsequent month.

The Northern Territories Racing Fee discovered that Ladbrokes had contacted Fineff out of the blue. That’s after staff heard about his prodigious playing at one other sportsbook, inviting him to join a Ladbrokes account.

This was the primary breach of the code. The opposite two associated to the corporate’s failure to react to crimson flags raised by Fineff’s playing habits. However the regulator decided that the bets have been authorized, which might have resulted within the firm being fined for the complete quantity.

Regardless of the failings of Ladbrokes with respect to its compliance with its license situations and the 2016 and 2019 Codes, the integrity of every wager positioned by [Fineff] with Ladbrokes has not been undermined to the extent the place every wager shouldn’t be enforced,” the regulator stated.

The fee decided that Ladbrokes’ interactions with Fineff weren’t enough for employees to “kind an affordable suspicion” that a few of his betting funds might need been the proceeds of crime.

UK Hassle

The absence of information of felony spending wasn’t sufficient to spare Entain from the wrath of the UK Playing Fee in August 2022. That’s when it handed the corporate a file £17 million (US$21 million) superb for a sequence of “utterly unacceptable” social accountability and anti-money laundering failures.

The corporate allowed a number of prospects to gamble massive sums of cash, together with one who employees knew lived in social housing, with out the correct checks and balances.

The regulator stated that additional infractions might outcome within the lack of its UK license.