Gaming Execs Anticipate Decline in Client Exercise, Diminished Hiring

Gaming executives are constructive on present situations within the trade, however extra subdued of their outlooks for the subsequent couple of quarters with some forecasting retrenchment in shopper spending.

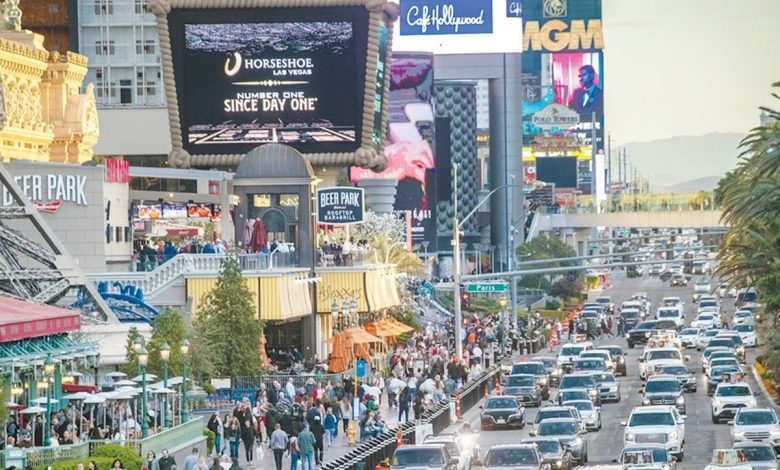

The Las Vegas Strip. Gaming executives are reserved of their outlooks and count on to rent much less. (Picture: Las Vegas Solar)

Within the newest version of the American Gaming Affiliation’s (AGA) Gaming Industry Outlook, 88% of respondents stated they view the present state of the enterprise as “good” or “passable”, however their three-to-six-month outlook is simply 3% web constructive in comparison with 28% web detrimental. That web detrimental determine is up from simply 4% within the first quarter.

The share of extra conservative responses on measures equivalent to future enterprise situations outweighed extra constructive responses by 8.7 proportion factors this quarter (8.7% web detrimental), in comparison with 6.3% web constructive in Q1 2024,” based on the commerce group. “For instance, on this quarter’s survey, barely extra gaming executives anticipate the tempo of income development to decelerate somewhat than speed up over the subsequent three to 6 months (16% web detrimental).”

The AGA’s Future Situations Index jibes with expectations that US GDP development is more likely to gradual within the coming quarters, however that the world’s largest economic system is more likely to avert a recession. The third quarter studying of the index was 98.9, indicating a local weather wherein gaming sector exercise “is predicted to reasonably lower over the subsequent six months (1.1% annualized price)” when adjusted for inflation.

Gaming Execs Sees Declines in Hiring, Spending

Working land-based casinos is a capital-intensive endeavor and that’s not going to alter, however with 2024 marking the tip of serious near-term expenditures for some corporations within the house, a extra tight-fisted strategy is predicted going ahead.

The web detrimental price amongst executives polled by AGA concerning hiring developments is 56%, whereas 15% have web detrimental views on upcoming capital spending. On the upside, restrained spending, together with extra prudence when it comes to including employees, signifies extra operators are prioritizing the energy of their stability sheets. Thirty-four p.c of executives polled by the AGA have web constructive views about their companies’ fiscal positions.

Relating to capital expenditures, nongaming areas will probably be factors of emphasis for operators.

“Lodge (56%) and meals and beverage services (56%) proceed to be the principle and rising focus of capital funding amongst operators, adopted by dwell leisure (28%) and on line casino flooring slots (22%),” based on the AGA survey.

Entry to Credit score Vital, Enhancing

Final week, the Federal Reserve lowered rates of interest by 50 foundation factors and Fed funds futures indicate one other 100 foundation factors price of cuts by the second quarter of 2025, however gaming administration groups are nonetheless involved about inflation and rates of interest.

Inflationary or rate of interest considerations proceed to be cited by some as a key issue limiting operations (28%). Nevertheless, practically all gaming executives report that monetary situations are accommodative, with extra viewing entry to credit score as straightforward (19%) than restrictive (3%) for the primary time in two years,” famous the AGA examine.

The excellent news for the trade is entry to credit score stays robust and is enhancing. As simply two examples, MGM Resorts Worldwide (NYSE: MGM) lately bought $850 million in debt, upsizing that providing from $675 million amid robust demand, and Wynn Resorts (NASDAQ: WYNN) bought $800 million in company bonds.