IRS Cracks Down on $13B in Unreported Playing Winnings

After an audit revealed that Uncle Sam might have let greater than $1 billion in revenue tax on latest on line casino jackpots go uncollected, the IRS is cracking down on the oversight. And one in every of Las Vegas’ most recognizable on line casino gamblers finds himself within the crackdown’s crosshairs.

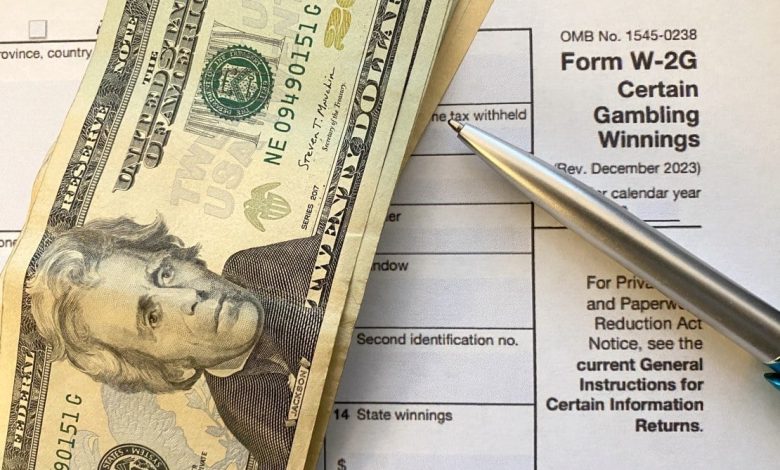

The IRS type W-2G is issued for each slot jackpot of $1,200 or extra or each Keno win of $1,500 or extra. (Picture: On line casino.org)

The information was delivered by this Sept. 30 report from the impartial IRS watchdog group Treasury Inspector Normal for Tax Administration (TIGTA). It discovered that 148,908 People with playing winnings exceeding $15,000 didn’t file tax returns between 2018 and 2020.

Their winnings exceeded $13.2 billion {dollars}, making the unpaid taxes simply north of $1.4 billion.

TIGTA analyzed the W-2G types generated by casinos when gamblers hit slot jackpots of $1,200 or extra or Keno wins of $1,500 or extra. Its report famous that 103,000 of those delinquent winners have been by no means issued notices or confronted with efforts to deliver them into compliance.

In a response to the report, the IRS wrote, “We agree with the advice,” vowing to start enforcement actions.

The Inner Income Code states that positive factors from playing are absolutely taxable and have to be reported as revenue by particular person taxpayers. Playing losses could also be deducted for filers itemizing as much as the quantity of their winnings.

Different Findings

Among the many TIGTA report’s different considerations have been tons of of W-2Gs that have been filed by casinos with out the required taxpayer identification numbers. This makes it extraordinarily troublesome for the IRS to hint the winnings to its recipients.

Additionally, the watchdog group famous, the IRS has too few processes in place to determine noncompliance with excise taxes by playing operators, notably within the quickly rising on-line sports-betting market.

The IRS additionally agreed with the latter suggestion. Nonetheless, it disputed the importance of the W-2Gs with out taxpayer IDs, for the reason that quantity was small.

“Whereas this inhabitants is probably not massive in absolute phrases, we imagine that the quantity of backup withholding that ought to have been withheld is critical,” TIGTA responded.

Code Changes

Kind W-2G’s Abstract of Withholding Necessities doesn’t at present single out earnings from sports activities playing or iGaming. Sports activities betting is among the many fastest-growing sectors of the U.S. gaming trade, with retail and/or on-line sportsbooks regulated in 38 states and Washington, D.C.

(Picture: IRS.gov)

(Picture: IRS.gov)

The IRS has obliged to particularly inform taxpayers of their submitting necessities for sports activities betting and on-line on line casino playing winnings.

“Kind W-2G has not developed with the expansion of the playing trade,” TIGTA’s report learn. “For instance, the wager codes on Kind W-2G embody solely 9 particular kinds of playing actions, which don’t embody a wager code for sports activities betting. If there was a wager code particularly for sports activities betting, the IRS might use this data to determine potential non-filers and under-reporters.”

The Treasury estimates that U.S. taxpayers underpaid their federal taxes by $688 billion in 2021, with non-filers accountable for 11% of the unreceived funds. The IRS’ Failure to File penalty is 5% of the unpaid taxes for every month or a part of a month {that a} tax return is late. The utmost penalty is 25% of the unpaid tax.

The IRS usually reserves legal prosecution for distinctive instances the place huge fraud and tax evasion proof is rampant.

Important Error

Scott Roeben, founding father of On line casino.org’s personal Important Vegas weblog. (Picture: Scott Roeben/Important Vegas)

Scott Roeben, founding father of On line casino.org’s personal Important Vegas weblog. (Picture: Scott Roeben/Important Vegas)

Final month, Scott Roeben, founding father of On line casino.org’s personal Important Vegas, acquired an IRS audit letter concerning taxes on $100,000 in unreported W-2G revenue in 2022.

The letter gave him 30 days to reply with particular four-year-old documentation or “additional steps” would ensue.

The one drawback, Roeben says, is that he filed his 2022 tax return on time, with all playing revenue reported.

“I filed every thing correctly,” he stated. “I simply had numerous jackpots, in order that triggered the audit, presumably.”

Roeben known as the IRS’s marketing campaign “selective persecution of on line casino patrons due to the stigma hooked up to playing,” including that it demonstrates “how out of contact the IRS is with the fact of playing.”

“That is making individuals leap by way of hoops, spend cash on tax professionals to assist with their audits and rethink a pursuit they take pleasure in,” he says, including that, even within the case of tax cheats, “jackpots are removed from your entire image in terms of playing.

“It’s like saying passengers of the Titanic had an absolute blast for two,070 miles.”