Malta Gray Record Elimination by Monetary Motion Job Drive Untimely – Opinion

In the summertime of 2022, the Monetary Motion Job Drive (FATF) determined that Malta, a serious hub of on-line gaming exercise, had come a good distance towards assembly its monetary integrity pointers. It eliminated the Mediterranean island nation from its gray record, lifting restrictions and the potential for extreme penalties. However new investigations present that it could have acted too rapidly.

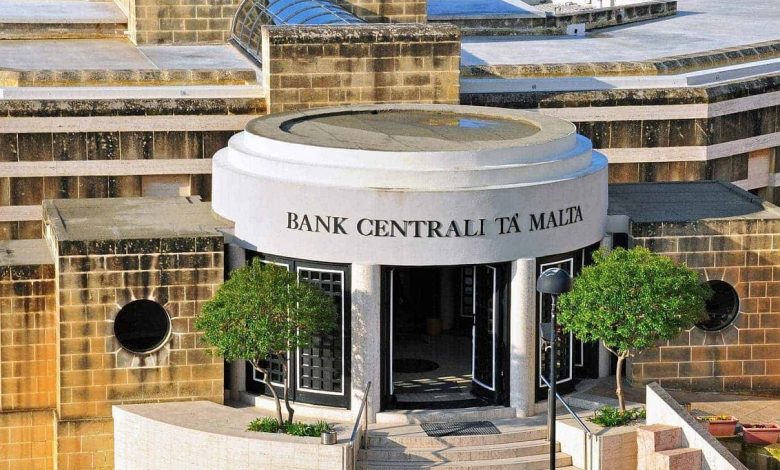

An aerial view of the Central Financial institution of Malta. Even after the nation was eliminated, there have been nonetheless examples of cash laundering occurring. (Picture: Alamy)

The FATF, the world’s monetary and anti-money laundering (AML) watchdog, explains that nations on the gray record are topic to elevated monitoring. These nations are “actively working with the FATF to deal with strategic deficiencies of their regimes to counter cash laundering, terrorist financing, and proliferation financing.”

The watchdog decided, in June 2022, that Malta now not wanted to be subjected to elevated monitoring. Nevertheless, the nation is reportedly nonetheless the go-to goal for crooks and embezzlers. This has the potential for billions of {dollars} in soiled cash to maintain flowing via its banks.

All Cash Welcome, No Questions Requested

AP Information reported final week that Alvaro Ledo Nass, a Venezuelan lawyer, had his fingers deep in a serious money-laundering scheme. He helped direct the state-run oil firm Petroleos de Venezuela, S.A., at one level cleansing round $1.2 billion in misappropriated funds. About $547 million went via Malta.

Nass additionally acquired bribes of greater than $11 million over a five-year interval between 2012 and 2017. That cash was a part of a large, $600-million mortgage deal. The lawyer needed to discover a place to park his ill-gotten funds, so he allegedly selected places in Spain, the Bahamas, New Jersey, and presumably, Malta.

Malta’s involvement surfaced as Nass appeared in a Miami federal court docket to face costs of cash laundering. He grew to become a whistleblower in a bigger case that additionally implicates Venezuelan President Nicolás Maduro.

Three of Maduro’s stepsons allegedly helped launder the $1.2 billion illegally siphoned out of the oil firm. Maltese monetary establishments accepted 10 wire transfers for the $547 million and by no means seemed again.

Venezuela isn’t alone. In 2020, studies surfaced that Congolese businessman Sindika Dokolo and his spouse, Isabel dos Santos, used shell corporations to misappropriate billions of {dollars}. A lot of that went via Malta.

Greater than only a businessman’s spouse, dos Santos is the daughter of Angola’s former President and dictator, José Eduardo dos Santos. At one level, Forbes listed her because the richest girl in Africa. She might have achieved that rank via criminal activity. Dokolo and dos Santos allegedly used their positions to reside the excessive life off of funds they embezzled from the federal government.

Then there’s Faruk Fatih Özer, a Turkish entrepreneur who ripped off Thodex, the cryptocurrency alternate he based. He stashed over $14 million in Malta earlier than police arrested him final yr in Albania.

FATF Neglects the Information

Malta landed on the FATF gray record in June 2021 and solely remained there for a yr. Among the billion-dollar scandals had been nonetheless persevering with whereas it was on that record. When the watchdog eliminated Malta from the record final summer season, it asserted it was “happy that Malta has efficiently carried out a sequence of reforms that it advisable final yr.”

That was solely two years after Malta decided that the previous head of the Malta Monetary Companies Authority, Joseph Cuschieri, violated native and European Union-level ethics laws. He traveled to Las Vegas with Yorgen Fenech, the controversial businessman and playing entrepreneur now on trial for allegedly murdering journalist Daphne Caruana Galizia.

That scandal remains to be in play, and has reached the very best ranges of presidency. It led to the resignation of then-Prime Minister Joseph Muscat in 2019. The case consists of hypothesis of cash laundering, bribery, and different violations.

Mixed with the opposite latest scandals, it seems the FATF might have eliminated Malta from its gray record prematurely.