Nevada Delays Licensing Of MGM Investor Diller Amid Fed Choices Probe

The Nevada Gaming Fee (NGC) is suspending licensing of Barry Diller — the media mogul whose IAC/InterActiveCorp (NASDAQ:IAC) is the biggest shareholder in MGM Resorts Worldwide (NYSE:MGM) — amid a federal investigation into his choices trades in Activision (NASDAQ:ATVII) previous to Microsoft (NASDAQ:MSFT) saying it’s buying the online game writer.

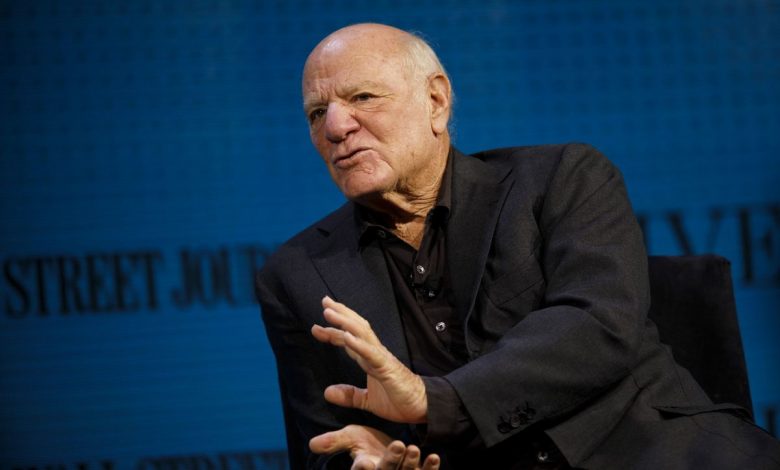

IAC Chairman and MGM investor Barry Diller. Nevada regulators are delaying his licensing amid a federal probe into his choices commerce in Activision. (Picture: Bloomberg)

Final week, information broke that the US Division of Justice and Securities and Trade Fee (SEC) are trying into whether or not or not choices trades positioned by Diller, his stepson Alexander von Furstenberg, and legendary leisure government David Geffen on the online game firm may represent insider buying and selling.

At a gathering earlier at the moment, NGC Chairwoman Jennifer Togliatti stated it is smart to have the Nevada Gaming Management Board (NGCB) look into the matter somewhat than conducting a query and reply session with Diller. NGCB really useful licensing for Diller and IAC previous to information of the federal investigation changing into public.

Diller, 80, wasn’t current at at the moment’s NGC assembly, nor was IAC CEO, Joey Levin. Each males maintain board seats at MGM.

Why It Issues

IAC took a 12% stake, then valued at $1 billion, in MGM Resorts in August 2020. That was a rarity for Diller’s firm, which usually doesn’t make passive fairness investments in massive, established firms.

Since then, the connection has grown cozier, and IAC’s place within the Bellagio operator elevated to 14%. Diller’s firm supplied financing for MGM’s early 2021 tried acquisition of Entain Plc — the gaming firm’s 50/50 accomplice on the BetMGM enterprise. That deal didn’t come to fruition, as Entain known as the supply insufficient.

Extra just lately, IAC partnered with the on line casino operator to buy $405 million price of MGM inventory from Keith Meister’s Corvex Administration, trimming the variety of shares excellent within the course of.

IAC is benefiting, too. When the corporate introduced its stake in MGM, the latter’s inventory commerce within the low $20s. Immediately, it flirted with $42.

Diller Says He Was Fortunate

Diller, Geffen and Von Furstenberg purchased name choices on Activision earlier than Microsoft stated it’s buying the Name of Responsibility writer for $68.7 billion. The Wall Avenue Journal reported the trio are sitting on paper good points of $60 million as of final week.

Diller stated it was not more than “a fortunate guess,” and that neither he nor his compatriots had any inside data concerning a attainable takeover of the online game firm.

Even when all the $60 million belonged to Diller, it’d signify a scant proportion of his web price of $4.6 billion.