Wynn UAE On line casino to Profit from Demographics, Taxes

Wynn Resorts’ (NASDAQ: WYNN) built-in resort within the United Arab Emirates (UAE) is poised to learn from engaging demographics and a positive tax regime, in line with JPMorgan analysts.

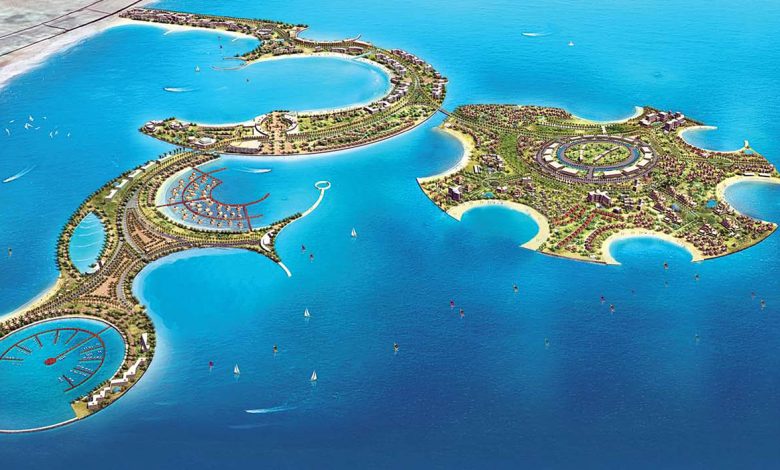

Al-Marjan Island within the UAE, web site of Wynn’s on line casino resort. JPMorgan believes the venue shall be a long-term success. (Picture: Arabian Enterprise)

In a brand new report back to shoppers, analysts led by Joseph Greff famous that Wynn Al Marjan Island in Ras Al Khaimah (RAK) may draw from a profitable shopper pool. At an investor occasion in Las Vegas earlier this week, Wynn famous the on line casino resort is a 50-minute drive from Dubai Worldwide Airport, placing it inside an eight-hour flight for 96% of the world’s inhabitants. Greff and his crew narrowed that pool.

Core goal markets signify roughly 25 % of the world’s inhabitants, 20 % of worldwide GDP, and almost 20% of the world’s millionaires,” wrote the JPMorgan analysts.

The Wynn venue, which would be the first regulated on line casino resort within the Arab world, is underneath building and anticipated to open in early 2027. With the UAE’s huge oil wealth and its rising variety of ultra-wealthy residents, coupled with Dubai’s standing as a playground for the elite, demographics are related to Wynn Al Marjan Island and clarify why some analysts are evaluating the UAE’s nonetheless nascent on line casino market to Singapore’s.

UAE Regulatory Setup Favorable for Wynn On line casino

On the investor occasion, Wynn mentioned the price range for the UAE enterprise has expanded to $5.1 billion and its anticipated capital contribution shall be $1.1 billion. Wanting additional out, the operator expects the UAE on line casino resort to generate adjusted property earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA) of $390 million to $570 million on gross sales of $1.38 billion to $1.88 billion.

A free cash-flow forecast of $170 million to $350 million and an anticipated return on invested capital of 9.8% to fifteen.7% are inline with analyst estimates. Greff mentioned these forecasts aren’t significantly aggressive, and the UAE’s gaming regulatory setting seems hospitable.

“The regulatory framework compares favorably with a few of the largest IR markets on the earth, sporting a ten % to 12 % tax charge on gross gaming income (GGR),” added the analyst.

That compares with the 40% charge in Macau. Talking of Macau, the place Wynn’s Macau arm runs two on line casino inns, there’s a 10-year licensing interval within the Chinese language territory, however Wynn Al Marjan Island has been granted a 15-year allow.

UAE May Be ‘License-Constrained’

Wynn rival MGM Resorts Worldwide (NYSE: MGM) has declared an intent to bid for a on line casino license at what’s at present a nongaming resort advanced within the UAE, however Wynn Al Marjan is predicted to have a prolonged head begin on different gaming venues within the area, and regulators there are more likely to be pragmatic in issuing new permits.

We predict this market [UAE], which can probably be license-constrained and targeted on the high-propensity-to-spend luxurious client within the area, has the potential to have related traits because the engaging and excessive return-on-investment Singapore IR market,” in line with Greff.

The analyst added that estimates of $3 billion to $5 billion for UAE’s whole addressable gaming market may show conservative over the long run, and the Wynn property will maintain a monopoly there “for at the least a few years.”